capital gains tax increase 2021 retroactive

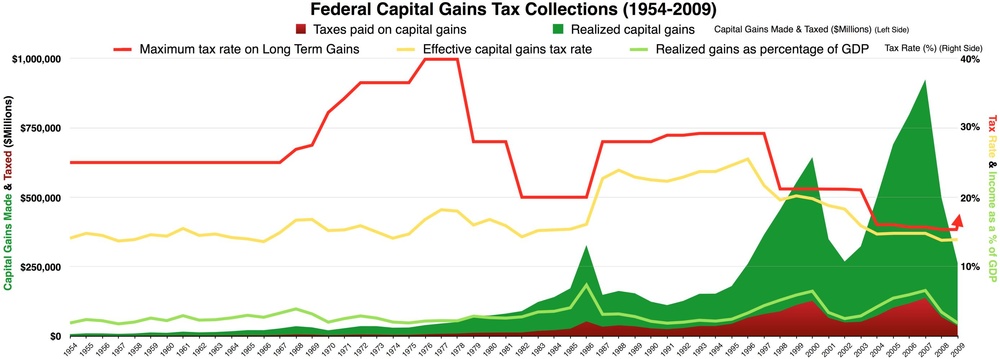

Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis. X Maximum capital gains tax rate.

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

In his budget plan released May 28 Biden proposed making the capital gains tax changes retroactive to April 2021 in order to prevent wealthy.

. Earlier this year President Biden proposed a 2022 budget for the federal government along with a Greenbook explaining corresponding proposed changes to the tax code. With tax writers launching mark-ups as early as Sept. 27 deadline there could be imminent action triggering an effective.

As expected the Presidents proposal would increase the top marginal ordinary income tax rate from 37 to 396 and would apply ordinary income tax rates to capital gains. Year-end planning for 2021 is more challenging than usual due to the uncertainty surrounding pending legislation that could among other things increase top tax rates on ordinary income and capital gains starting next year. For example in 2021 individual filers wont pay any capital gains tax if their total taxable income is 40400 or below.

Accordingly there is nothing stopping Congress from passing the Biden tax plan and making the proposed 396 top capital gains rate retroactive to some point earlier this year. Note is paid off in full so no deferred tax liability. Appendix Top 2020 marginal tax rates for capital gains and dividends The following table illustrates the current top marginal tax rate on capital gains by provinceterritory as well as the potential top marginal tax rate on capital gains if the inclusion rate increases to 66 2 3 or 75.

If you add state taxes like Californias. Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the. Having resolved the infrastructure bill Congress now begins debate and consideration of the budget through a reconciliation process since that can be passed with 50 votes bypassing the normal process that subjects.

Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike effective starting in April 2021. Wages can face federal tax of 408 once you include payroll tax but hiking the top 238 capital gain rate to 434 would be a staggering 82 increase. 2022 And 2021.

Yellen Argues Capital Gains Hike From April 2021 Not Retroactive. June 16 2021 1108 AM PDT. President Bidens blockbuster 6 trillion budget assumes that his proposed capital-gains tax hike took effect in April according to the Wall Street Journal.

Retroactive Capital Gains Tax Hike On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital. The effective date for the capital-gains tax rate. Biden has proposed raising the top tax rate on capital gains to 434 percent from 238 percent for households with income over 1 million.

642857 x Underpayment Rate. Heres how financial advisors are responding. Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary.

President Joe Biden is calling for a 396 top capital gains tax rate retroactive to the date of announcement. The current maximum 20 rate will continue to apply to gains earned prior to September 13 2021 as well as any gains that originate from transactions entered into under binding written contracts prior to September 13 2021. Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike.

However theyll pay 15 percent on capital gains if their income is 40401 to 445850. Wages can face federal tax of 408 once you include payroll tax but hiking the top 238 capital gain rate to 434 would be a staggering 82 increase. 9 and racing against a Sept.

Retroactive Tax Increase. Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment decisions. Proposed Biden Retroactive Capital Gains Tax Could Be Challenged on Constitutional Grounds.

The same rate of tax as capital gains which. A historical review suggests that any tax legislation enacted in 2021 could have retroactive effect to transactions completed at any time in 2021. 7 rows 2021 federal capital gains tax rates.

Long-term capital gains are. AUGUST 11 2021 BYJOE BISHOP-HENCHMAN. If the Democratic Tax Bill Passes Will It Be Retroactive To January 1 2021.

A natural reaction to a looming tax hike is to sell quickly before the new law takes effect. The effective date of any increase in the long-term capital gains tax rate. The maximum capital gains are taxed would also increase from 20 to 25.

If you add state taxes like Californias current 133 rate the government gets most of your gain. 13 will be taxed at top rate of 20. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1 million effective for all sales on or after April 2021.

The table also shows the inclusion Eligible.

Sometimes It Can Be Tempting To Escape Into The Rage Quitting Daydream When Work Is A Nightmare But Instead Of Esca In 2021 How Are You Feeling Rage Quit Quitting Job

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Managing Tax Rate Uncertainty Russell Investments

Managing Tax Rate Uncertainty Russell Investments

A Probable Capital Gains Tax Rate Increase And The Potential In Opportunity Zones Caliber

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

How To Help Your Real Estate Investor Clients Structure Their Businesses Accounting Today In 2021 Real Estate Investor Real Estate Investors

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Globalization And Capital Taxation Two Laffer Curves Download Scientific Diagram

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

What Can The Wealthy Do About Biden S Proposed Tax Increases