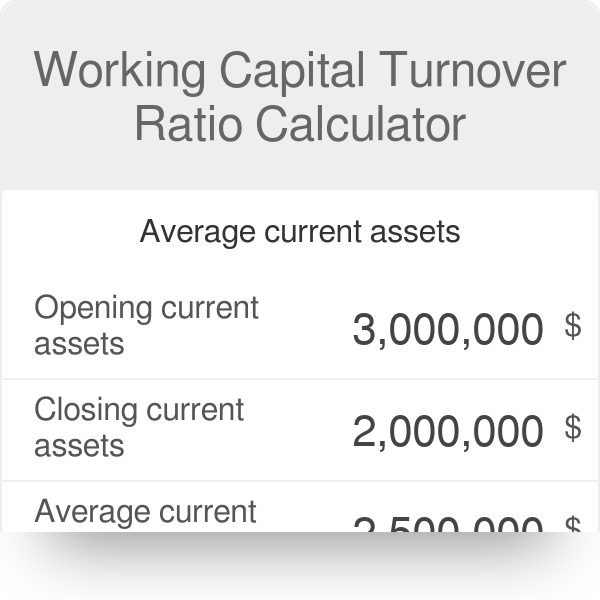

working capital turnover ratio calculator

An increasing Working Capital Turnover is usually a positive sign. Some startups however may have calculated their working capital turnover ratio.

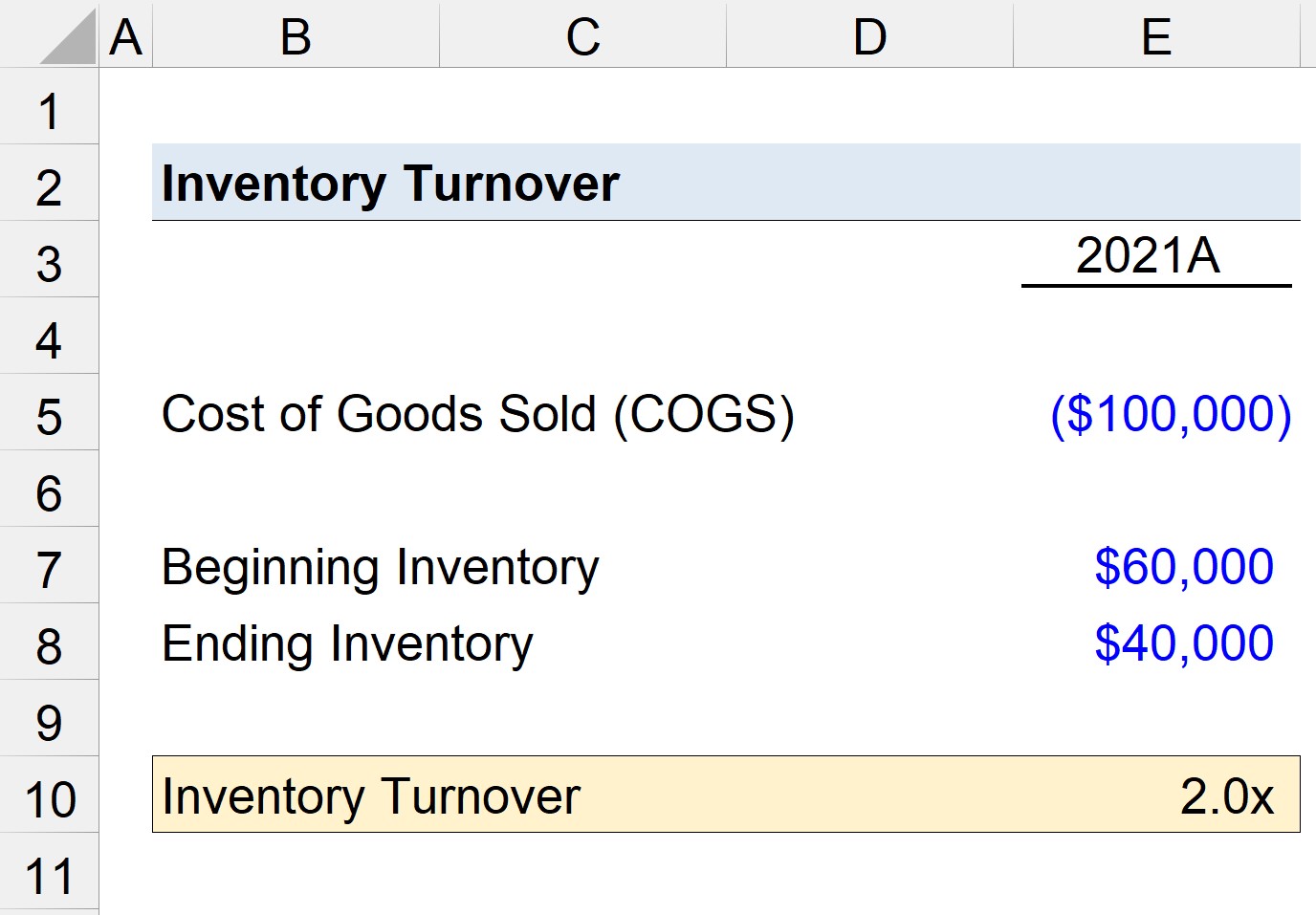

Inventory Turnover Formula Analysis And Ratio Calculator

Both of these figures should be reported on your balance sheet.

. If your organization has 500000 in current assets and 300000 in total current liabilities your working capital is 200000. Hence the working capital turnover for Company Alpha is 8000000 1600000 5x. Working capital turnover revenue average working capital.

To arrive at the average working capital you can sum. Generally a higher ratio is better and suggests that the company does not require more funds. In general a high ratio can help your companys operations run more smoothly and limit the need for additional funding.

420000 60000. The Working Capital Turnover ratio measures the companys Net Sales from the Working Capital generated. Net Working Capital NWC 60000 80000 40000 5000 NWC 95000.

Working capital turnover ratio. We need to calculate Working Capital using Formula ie. A higher ratio indicates greater efficiency.

WC dfrac 100 000 180 000 2 140 000 latex Now we can calculate the working capital turnover ratio. Putting the values in the formula of working capital turnover ratio we get. Working capital turnover ratio formula.

If keeping track of all these variables sounds complicated to you dont worry just put all the numbers into our working capital turnover ratio calculator to get your answer. Working capital can be calculated by subtracting the current assets from the current liabilities like so. Average working capital would be the average of 20000 and 24000.

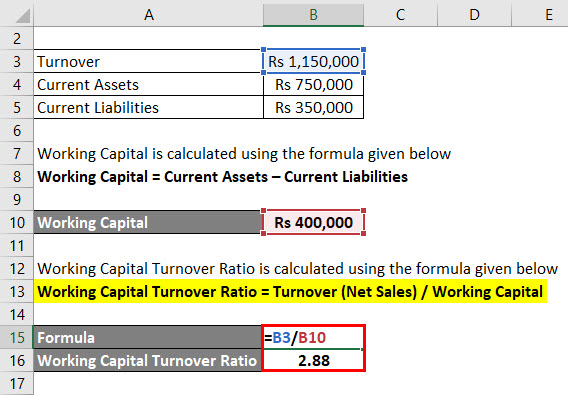

Working Capital Rs 400000. Working Capital Current Assets Current Liabilities. Working Capital Turnover Ratio Cost of Sales Net Working Capital.

To do so take your current assets and subtract your total current liabilities. What is the working capital turnover ratio for Year 3. Pin Page Current Assets 10000 5000 25000 20000 60000.

You need to provide the two inputs ie. The formula to measure the working capital turnover ratio is as follows. Once youve got that number divide your net sales for the.

It is very easy and simple. To do so take your current assets and subtract your total current liabilities. The working capital turnover calculator helps determine the efficient working of this by the management.

But an extreme higher ratio may also have drawbacks attached to it. About Working Capital Turnover. Working capital turnover is a measurement comparing the depletion of working capital used to fund operations and purchase inventory which is then converted into sales revenue for the company.

Calculate working capital turnover ratio. Everything you need to know about funding growing and scaling your startup. Since we now have the two necessary inputs to calculate the working capital turnover the remaining step is to divide net sales by NWC.

This means that for every 1 spent on the business it is providing net sales of 7. First lets calculate the average working capital. Net Working Capital Current assets.

Working Capital Current Assets Current Liabilities. The working capital turnover ratio measures how efficiently a business uses its working capital to produce sales. Before you can calculate your working capital turnover ratio you need to figure out your working capital if you dont know it already.

Now working capital Current assets Current liabilities. Test your knowledge of the Working Capital Turnover Ratio by taking the quiz below. You can easily calculate the Working Capital using the Formula in the template provided.

Working capital Turnover ratio Net Sales Working Capital. WC Turnover Ratio Revenue Average Working Capital. The resulting number is your working capital turnover ratio.

What Is the Working Capital Turnover Ratio and How Is It Calculated. Current Assets 10000 5000 25000 20000 60000. For example if a company makes 10 million in sales during a calendar.

Working Capital Turnover Ratio is calculated using the formula given below. Similarly a lower ratio depicts poor management of short-term funds. The Startup Finance Blog.

The calculation would be sales of 320000 divided by average working capital of 22000 which equals a working capital turnover ratio of 145 times. Once you know your working capital amount divide your net sales for the year by your working capital amount for that same year. From the 20x working capital turnover ratio we can conclude that the.

Current Assets and Current Liabilities. Information about your total liabilities and your total assets can typically be found on your balance sheet. Use the following working capital turnover ratio formula to calculate the working capital turnover ratio.

Working Capital Turnover 190000 95000 20x. This means that for every one dollar invested in working capital the company generates 2 in sales. The working capital turnover ratio is the proportion of net sales to working.

Working capital is calculated by subtracting a companys total liabilities debts from its total assets. Interpreting the Calculator Results If Working Capital Turnover increases over time. Working Capital Rs 750000 Rs 350000.

Current Liabilities 30000. Venture Debt is a financing structure similar to that of a traditional bank loan. Both of these figures should be reported on your balance sheet.

Before you can calculate your working capital turnover ratio you need to figure out your working capital if you dont know it already. Working Capital Current Assets - Current Liabilities. Now that we are aware of what Working Capital and Turnover are we can understand the Working Capital Turnover Ratio.

100000 40000. You can monitor the Working Capital Turnover Ratio to make sure you are optimizing use of the working capital. How effectively short-term resources are being used for sales is evaluated using the working capital turnover ratio.

Cost of Capital Calculator. Revenue-Based Financing provides company with working capital in exchange for a percentage of future monthly revenue. This company has a working capital turnover ratio of 2.

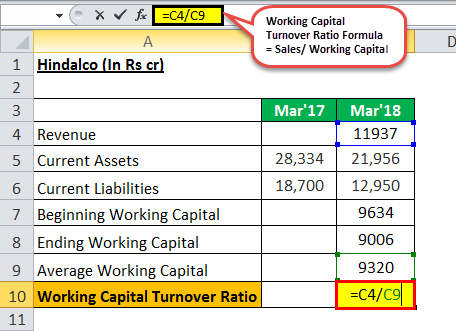

Working Capital Turnover Ratio Formula Calculator Excel Template

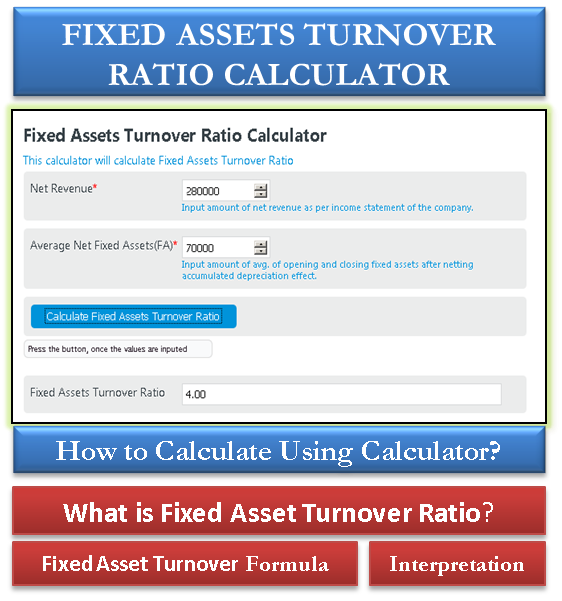

Fixed Asset Turnover Ratio Calculator With Formula Interpretation Efm

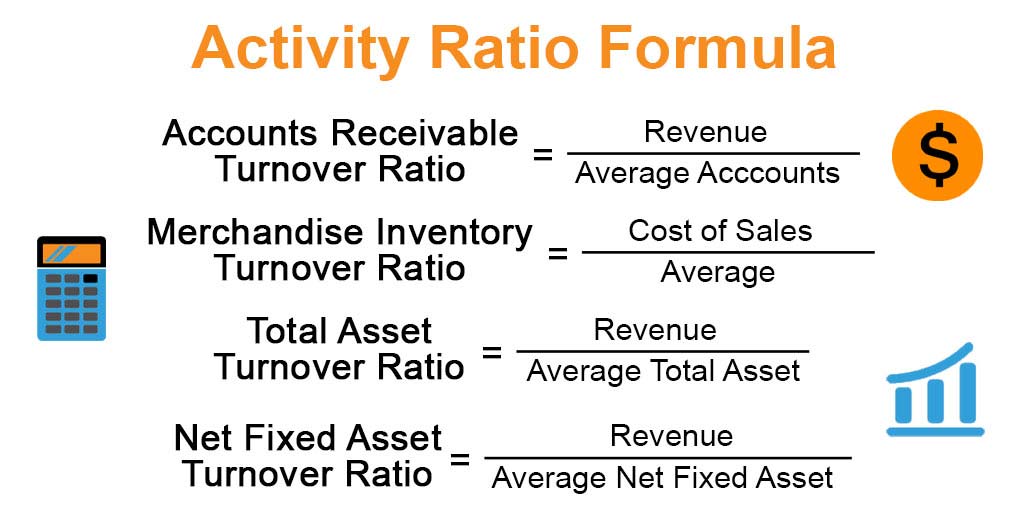

Activity Ratio Formula Calculator Example With Excel Template

Working Capital Turnover Ratio What It Is And How To Calculate It Planergy Software

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Turnover Ratio Formula And Calculator

How To Calculate Your Working Capital Turnover Ratio

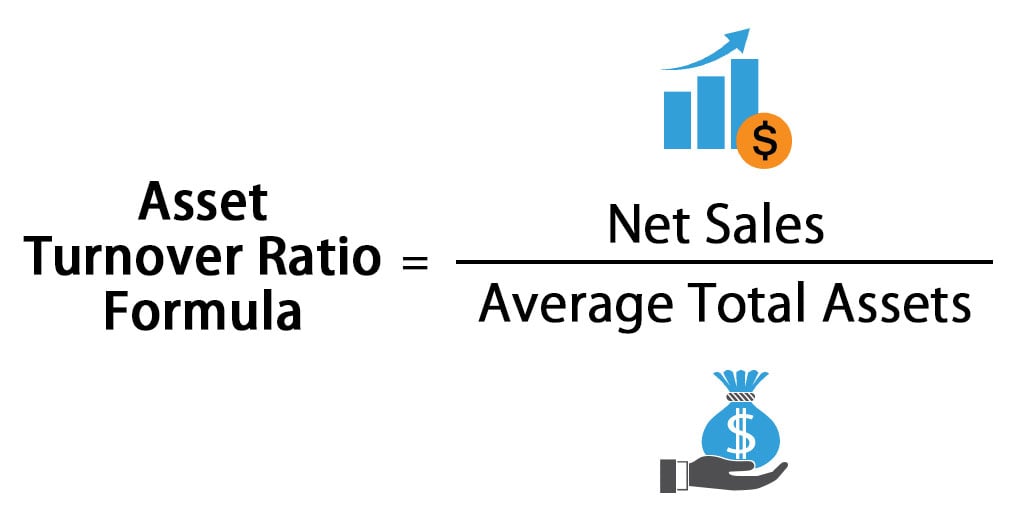

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Working Capital Turnover Ratio Formula And Calculator

Asset Turnover Ratio Formula Calculator Excel Template

Solvency Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Meaning Formula Calculation

Efficiency Ratios Archives Double Entry Bookkeeping

Asset Turnover Ratio Formula And Excel Calculator

Working Capital Turnover Ratio Formula Calculator Excel Template

Activity Ratio Formula And Turnover Efficiency Metrics